what is a limited pay whole life policy

A limited pay life policy is a type of whole life insurance. A limited payment whole life policy requires you to pay for the complete life insurance policy during the first few years.

Life Insurance Powerpoint Slides

Unless you choose to use the cash value to pay for.

. This policy is a better option for people who want to access their cash value in the future and. Limited pay policies work well for people who prefer not to pay. Limited Payment Life Insurance a life insurance policy that covers the insureds entire life with premium payments required only for a specified period of years.

A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame. Limited payment whole life insurance covers you for. A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no more premiums due.

Limited Payment Life Insurance a life insurance policy that covers the insureds entire life with premium payments required only for a specified period of Trending Popular. There are several types of limited pay life. A limited pay whole life insurance policy is not the right choice for every consumer.

Typically these types of policies are paid off in 10-20 years. Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime. Limited pay life insurance is a type of whole life insurance that has a shorter guaranteed payment period than a traditional whole life policy.

Limited pay whole life insurance is a type of permanent life insurance policy that is designed to pay all premiums on a predetermined schedule rather than annual payments for. A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a specific. You may select limited pay life insurance if.

This money can be. A limited pay life policy is a type of whole life insurance. With limited pay life you only.

Depending on the terms you make payments. A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment. With a limited pay whole life insurance policy you pay premiums for only a specific amount of time.

A limited pay life insurance policy is a policy that allows a person to set aside a fixed amount of money to cover their dependents if they die before earning a certain salary. A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance. What is whole life Limited.

Limited pay life insurance is a type of whole life insurance that allows you to prepay for the entire cost of your coverage for a set number of years. There are several types of. Limited pay life insurance is a type of whole life insurance with a much shorter guaranteed payment period than a usual whole life policy.

What is a Limited Pay Life Insurance Policy. A limited pay whole life policy is a type of whole life insurance that only requires premiums to be paid for a certain time can guarantee the premiums will stop and not return. 7-pay life insurance life paid up to 65 and.

Limited Pay Life Insurance Everything You Need To Know

Are Limited Pay Life Insurance Policies Ideal

Whole Life Insurance Pros And Cons White Coat Investor

The Complete Guide To Life Insurance The Dough Roller

Ppt Chapter 2 Life Insurance Policies Whole Life Insurance Powerpoint Presentation Id 1988231

Limited Pay Whole Life Insurance What Is It See The Numbers

What Is A Limited Pay Life Policy Clearsurance

What Are The Different Types Of Term Life Insurance Policies Iii

Limited Pay Whole Life Insurance Choosing A Policy Paradigmlife Net Blog

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

Lic Whole Life Policy Limited Payment Review Key Features Plan Benefits

Type Of Life Insurance Aa Tc Inc

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Solved Suppose You Are A Life Insurance Broker With A Client Chegg Com

What Is Limited Pay Whole Life Helpadvisor Com

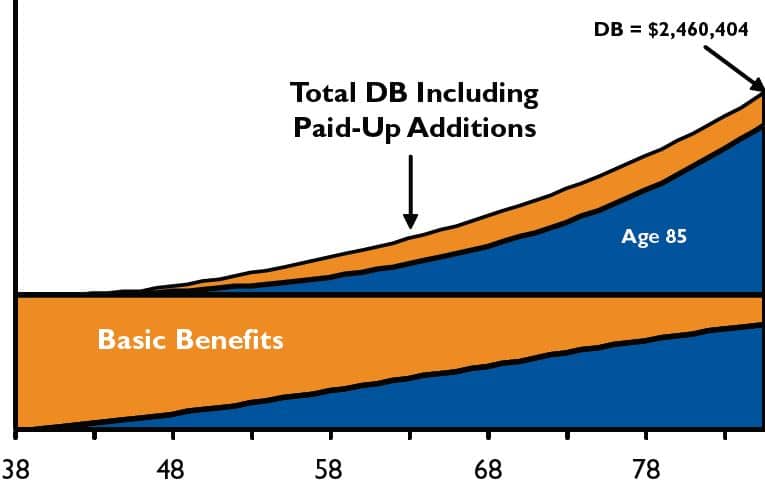

Whole Life S Guaranteed Growth And 4 Ways To Accelerate It For Banking Banking Truths

How To Buy A 1 Million Life Insurance Policy And When You Need It

Hand In Hand Mutual Fire Life Insurance Companies Whole Of Life Limited Payment Plan This Type Of Plan Is Suitable As Financial Security For Your Dependants And As